The forex market is one of the most difficult markets to trade. Nordic Traders has analyzed and experimented this market for many years, and and for this reason we know that 99,9% of all algorithms lose money over time.

There are many algorithms for sale online, and although it may seem that an algorithm performs really well, you should be aware that it can easily lose a lot of money all of a sudden.

This is because many algorithms are built based on a so-called Martingale system, in which you buy more when a trade goes in the red. This can work well for long periods, because the price of a currency pair tends to mean revert, i.e. return to the mean. This means that when there is a big move in one direction in a currency pair, you can expect the price to move back towards the mean over time.

Of course, this is not always the case, and in these situations a Martingale system can completely collapse because you keep buying up in the currency pairs in which you lose money.

Over the past year, Nordic Traders has experimented with different forex algorithms, and it has been an exciting journey. After a long time of research, we have found a single one that we use ourselves and that we would like to share with our audience.

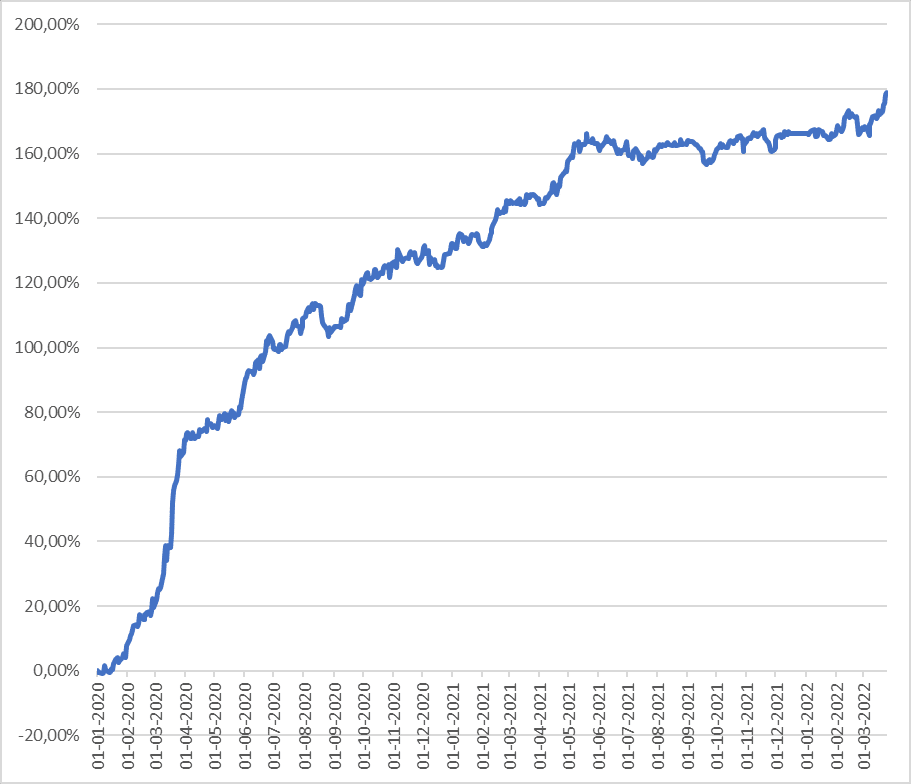

Below you can see the returns of the algorithm, which is based on 3 years of history.

For the first two years, the strategy has been traded in simulation, and over the past year, it has been traded on a real account with 40,000 USD. The return was 180% in this period, and the maximum drawdown was 15%, which shows that the system has had a limited risk during this period.

During these three years, more than 20,000 trades have been taken, and based on this, it is clear that the system has had an “edge” over the market. It has been a profitable system.

We have now chosen to share this with our users in a channel on the Telegram app.

If you follow this link, you will enter the Telegram channel, and if you do not have the Telegram app on your phone or computer, then you can just download it.

If you want to access to all signals, you can access our VIP channel. This is described in more detail, in the Telegram-channel.

This is how the strategy is built

The strategy trades some of the largest currency pairs such as EURUSD, EURJPY, AUDUSD, USDCAD etc. The price development of the currency pairs is dependent on combinations of three different elements:

1) Strength/weakness in US dollars

2) Risk-on/risk-off sentiment in risk assets.

3) Volatility levels and changes. The strategy also takes into account typical patterns in the foreign exchange market, such as mean reversion on all time horizons.

This strategy is uncorrelated with the stock market’s return, which has made it ideal to trade, especially in recent times when the return on the stock market has been negative.